A salary – also commonly referred to as a wage – is financial compensation for work performed and represents one of the fundamental rights of every employee. The amount and structure of a salary depend not only on the agreement between the employer and employee, but also on legal regulations that set the minimum wage, determine how pay is calculated, and outline mandatory deductions.

The starting point for every salary is the gross wage, which is usually stated in the employment contract or job advertisement. This is the amount before tax and compulsory contributions to health and social insurance are deducted.

What Does the Gross Wage Include?

The gross wage is typically made up of two main parts: a fixed (or basic) component and a variable component.

The fixed component is agreed upon in advance and cannot be changed by the employer without the employee’s consent. It provides stability and predictability in your income.

The variable component, on the other hand, may include various bonuses, incentives, performance-related pay, overtime, night shift allowances, weekend or public holiday pay, and other rewards. However, this part is not guaranteed – its amount and payment depend on specific conditions such as your performance or the company’s financial situation.

The law sets a minimum wage, which is reviewed and adjusted regularly. As of 2025, the monthly minimum wage in Slovakia is €816, with a minimum hourly rate of €4.69 for basic work. These rates also apply to contract-based employment.

No employer is allowed to pay less than the legal minimum, whether the employee is a Slovak national or a foreign worker.

Trends in Average and Minimum Wages in Slovakia (since 2009)

| Year | Average wage | Minimum wage |

| 2025 | 1658 € (estimate) | 816 € |

| 2024 | 1524 € | 750 € |

| 2023 | 1430 € | 700 € |

| 2022 | 1304 € | 646 € |

| 2021 | 1211 € | 623 € |

| 2020 | 1133 € | 580 € |

| 2019 | 1092 € | 520 € |

| 2018 | 1013 € | 480 € |

| 2017 | 954 € | 435 € |

| 2016 | 912 € | 405 € |

| 2015 | 883 € | 380 € |

| 2014 | 858 € | 352 € |

| 2013 | 824 € | 338 € |

| 2012 | 805 € | 327 € |

| 2011 | 786 € | 317 € |

| 2010 | 769 € | 308 € |

| 2009 | 745 € | 296 € |

Taxes, Contributions and Deductions

Mandatory deductions are taken from the gross salary. Employees contribute 13.4% towards health and social insurance, and after calculating the tax base, 19% income tax is also deducted.

In addition, the employer pays a further 35.2% in insurance contributions on top of the gross wage.

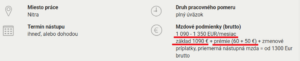

For example, if an employee agrees to a gross monthly salary of €1,000, their net income (the amount they actually receive) will be roughly €790. However, the employer’s total cost for this position will be around €1,360.

This total cost is sometimes referred to as the super-gross wage, as it reflects the full financial burden of employing a worker.

The difference between gross and net wages can vary even among employees with the same gross salary. This is because the net wage is influenced by a range of individual factors, such as: Tax bonuses (e.g. for dependent children), Allowances and deductions (e.g. meal contributions), Voluntary pension contributions (commonly referred to as the third pillar in Slovakia)

For this reason, most job advertisements in Slovakia indicate the gross salary, as the net amount received differs from person to person.

Payroll is usually managed by the company’s payroll department, which takes various factors into account when calculating salaries. These include: Hours worked, Paid holiday (annual leave), Sick leave, Business travel, Variable components of the salary (e.g. bonuses or overtime)

To estimate your net salary, you can use one of several online wage calculators available in Slovakia.

At the end of each pay period, employees receive a payslip, which provides a detailed breakdown of your wage.